Exploring Employer-Sponsored vs. Marketplace Health Insurance Plans

When it comes to health insurance, choosing between employer-sponsored and marketplace options can be tricky. Both offer different advantages and limitations. Understanding these differences will help you make a more informed decision about your coverage.

Employer-Sponsored Health Insurance

Employer-sponsored health insurance is coverage provided by your workplace. In this plan, employers typically pay a portion of the monthly premium. This reduces the out-of-pocket cost for employees. Employer-sponsored plans often come with a variety of options, including medical, dental, and vision coverage.

One significant advantage of employer-sponsored plans is the convenience. Most employers handle the administrative side of the policy. Employees simply sign up and are automatically enrolled. It’s also common for the employer to negotiate better rates since they’re providing insurance for many employees.

However, there are limitations. You may have fewer plan choices compared to individual plans. The options available are limited to what your employer offers. If you leave your job, you could lose your coverage, forcing you to look for a new plan quickly.

Read Also: The Evolution and Versatility of Paper Box Packaging: A Sustainable Solution

Marketplace Health Insurance

Marketplace health insurance is available to anyone. Unlike employer-sponsored plans, marketplace plans give individuals more control over their choices. You can compare different levels of coverage and costs, making it easier to find a plan that fits your needs and budget.

One of the main benefits of marketplace insurance is flexibility. You can choose a plan that suits your financial situation. Marketplace plans are also available to those who don’t have access to employer-sponsored coverage, offering a much-needed option for freelancers, part-time workers, or people in between jobs.

A possible downside of marketplace insurance is cost. Depending on your income, premiums may be higher without employer contributions. However, you might qualify for government subsidies based on your earnings, which can help offset these costs.

Key Differences

- Cost: Employer-sponsored plans often cost less for employees because the employer pays a portion. Marketplace health insurance may be more expensive, though subsidies can help reduce this.

- Flexibility: Marketplace plans offer more choice in terms of coverage and pricing, while employer-sponsored plans may be limited to a specific selection.

- Availability: Employer-sponsored plans are linked to your job. Marketplace plans are available to everyone, regardless of employment status.

- Portability: If you lose your job, you lose your employer-sponsored insurance. Marketplace plans are independent of employment and can follow you anywhere.

Which Is Right for You?

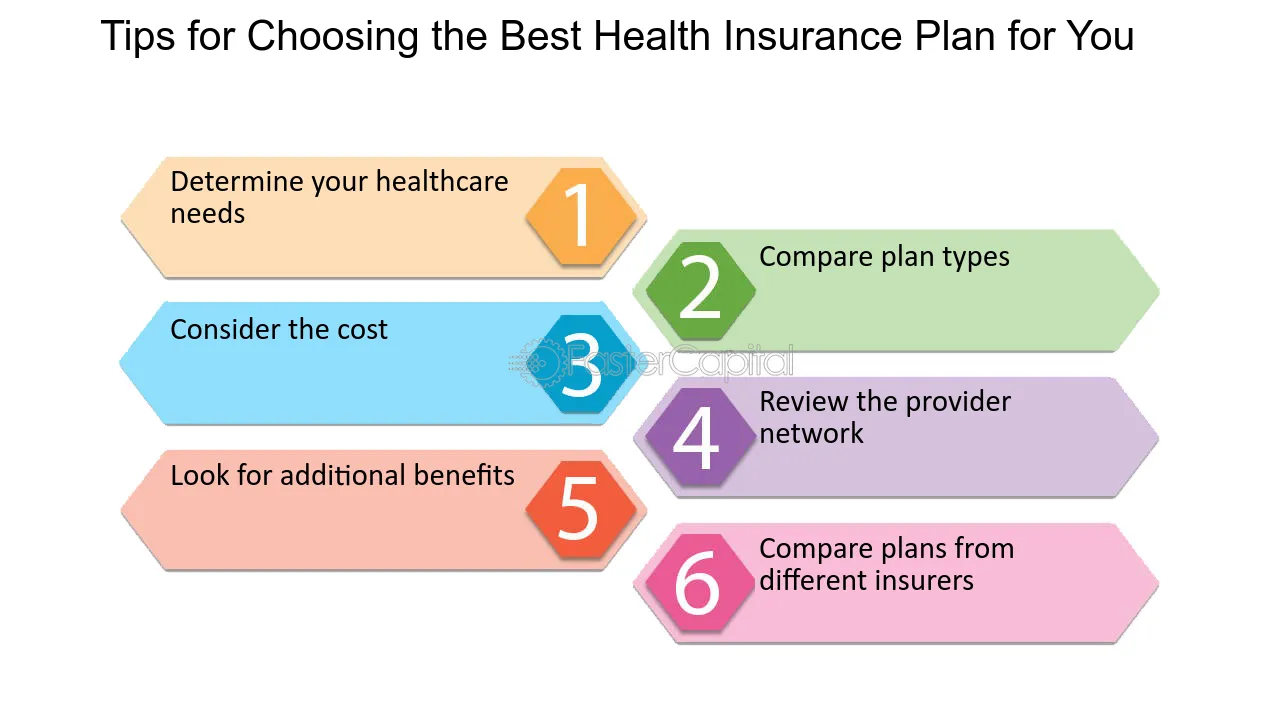

Choosing between these two options depends on your situation. If you have a stable job with good benefits, an employer-sponsored plan can be a more affordable and hassle-free option. On the other hand, if you need flexibility or don’t have access to an employer-sponsored plan, the marketplace could be your best bet.

Each option has its pros and cons, so weigh them carefully before making a decision.