Comparing Medicare Supplement Options: What’s Right for You?

Navigating the world of Medicare can feel overwhelming, especially when it comes to choosing the right Medicare Supplement Plan.

With a variety of options designed to address different needs, finding the perfect fit requires understanding your priorities and the benefits offered by each plan.

Whether you’re looking for broad coverage or a more affordable option, this guide will help you make an informed decision.

Find and compare Plans to ensure you get the best value for your healthcare needs.

What Are Medicare Supplement Plans?

Medicare Supplement Plans, also known as Medigap, are designed to fill the gaps in Original Medicare (Part A and Part B). These plans help cover expenses such as copayments, coinsurance, and deductibles that Medicare doesn’t cover.

Private insurance companies offer these plans, but all options are standardized, meaning the benefits remain the same regardless of the provider.

Key Factors to Consider

When choosing a Medicare Supplement Plan, it’s essential to evaluate several factors to determine which option aligns with your healthcare needs:

1. Coverage Needs

- Assess your current health and potential future medical expenses.

- If you frequently visit doctors or specialists, consider plans with comprehensive coverage.

- For those in good health, a lower-coverage plan might suffice.

2. Cost

- Monthly premiums vary by plan type, provider, and location.

- Consider not only the premium but also out-of-pocket costs such as deductibles and coinsurance.

- Compare plans to identify the balance between affordability and coverage.

3. Flexibility

- Some plans allow you to see any doctor that accepts Medicare, while others may have network restrictions.

- Choose a plan that offers flexibility if you travel frequently or have preferred healthcare providers.

4. State Regulations

- Medigap plans are standardized in most states, but some states, like Massachusetts, Minnesota, and Wisconsin, have their own rules.

- Ensure you understand the specifics in your area.

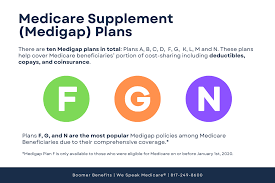

Types of Medicare Supplement Plans

Medicare Supplement Plans are labeled with letters A through N. Each offers a different combination of benefits. Here’s an overview of popular options:

- Plan F: Offers the most comprehensive coverage but is only available to those who became eligible for Medicare before January 1, 2020.

- Plan G: Similar to Plan F, but does not cover the Part B deductible.

- Plan N: Provides lower premiums with some copayments for doctor visits and emergency room visits.

- High-Deductible Plans: Available for Plans F and G, offering lower premiums in exchange for higher deductibles.

Read Also: Wholesale Sweatshirts: Affordable, Stylish, and Perfect for Every Season

How to Choose the Right Plan for You

Step 1: Assess Your Needs

Start by identifying your healthcare usage patterns and any anticipated changes. For example, if you require frequent treatments or specialist visits, comprehensive coverage may be a priority.

Step 2: Research Providers

Medigap plans are sold by private insurance companies. Research each provider’s reputation, customer service, and financial stability.

Step 3: Compare Costs

Use tools and resources to compare premiums and benefits side by side. Look for plans that align with your budget without compromising essential coverage.

Step 4: Consider Enrollment Timing

The best time to enroll in a Medicare Supplement Plan is during your Medigap Open Enrollment Period, which starts when you turn 65 and enroll in Part B. During this period, you’re guaranteed coverage without medical underwriting.

Benefits of the Right Plan

Choosing the right Medicare Supplement Plan can provide peace of mind and financial security. The right plan ensures that you’re not caught off guard by unexpected medical expenses and allows you to focus on maintaining your health.

With so many options available, taking the time to find and compare Plans is the first step toward securing the healthcare coverage that works for you.

Conclusion

Medicare Supplement Plans are a valuable resource for covering gaps in Original Medicare.

By carefully evaluating your needs, researching options, and comparing costs, you can select the plan that best aligns with your lifestyle and budget.

Make your healthcare coverage a priority and invest in the peace of mind that comes with the right Medicare Supplement Plan.